|

The California Senate has approved legislation that seeks to clarify homeowners’ insurance coverage following deadly mudslides near Santa Barbara. Insurance policies generally cover damage caused by fires but not by mudslides. That creates confusion in cases like the mudslides in Montecito, which were triggered by a wildfire. In such cases where multiple factors combine to cause damage, courts have ruled that insurers must pay if the policy covers the “efficient proximate cause,” the most important cause, of the damage.

Most insurers have agreed to cover damage in Montecito, but Sen. Hannah Beth Jackson thinks enshrining the existing legal doctrine in law would help future mudslide victims avoid prolonged fights with insurers. “It is important that the insurance industry know very clearly, without equivocation, their responsibility to their policyholders that they must cover these costs,” said Jackson, a Democrat from Santa Barbara. Insurers oppose the bill. Their lobbyists say it goes further than the existing legal interpretation and might force them to cover losses they wouldn’t otherwise have to cover. That could require them to raise their rates or decline to offer coverage in some areas, they say. “When you put something in statute, any interpretation of the courts, they’re going to presume that there’s a change in law,” said Armand Feliciano, vice president of government relations for the Property Casualty Insurers Association of America. “Otherwise why would the Legislature do it? Now you’ll have other lawsuits that probably didn’t need to happen.” The measure specifically says it’s not intended to change existing law, but Feliciano said there could still be legal disputes over the meaning. SB917 was approved in a 25-11 vote and goes next to the Assembly. More than $421 million in insurance claims have been filed for residential and commercial losses related to the mudslides, Insurance Commissioner Dave Jones said last month. Recently burned by California’s largest recorded wildfire, the hillsides of Montecito northwest of Los Angeles could not absorb the rainstorm with an epic downpour of nearly an inch (2.5 centimeters) in 15 minutes early on Jan. 9. Twenty-one people were killed and two remain missing. By Jonathan J. Cooper

0 Comments

Employers across the United States are ordering fewer tests for marijuana in prehire drug screens even as the number of positive drug tests is on the rise — a trend that is raising concerns about the potential implications for workplace safety. Screening dips in states that have approved marijuana for recreational use are particularly troubling, as they indicate that employers are forgoing drug testing due to legal risks and staffing issues.

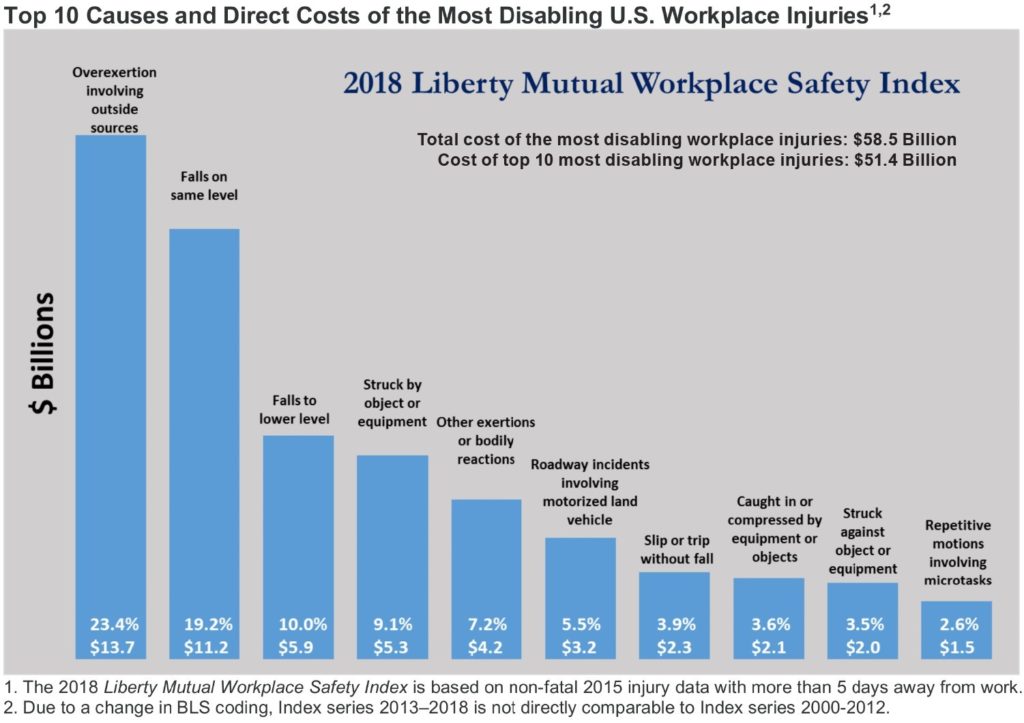

Nationwide, 99% of drug tests in 2016 included screening for marijuana, and in 2017 that figure dropped to 98.4%, according to data compiled by Barry Sample, Seneca, South Carolina-based senior director of science and technology for the employer solutions business at Quest Diagnostics Inc. States with legalized marijuana saw the highest drops in screening for the drug. According to Mr. Sample, 98.1% of employment drug tests in Colorado screened for marijuana in 2016, a figure that dropped to 96.2% in 2017; and 98.2% of tests in Washington state screened for marijuana in 2016, dropping to 97% of tests in 2017. About 70% of drug tests ordered in the workplace are for prehire screenings, he said. Such figures, set alongside recent data on an increase in positive drug tests in the workplace, are a safety concern, experts say, with 30 states and the District of Columbia legalizing medical marijuana and nine states approving its use recreationally. “This is a situation we have to pay attention to,” said Jim Smith, president of the American Society of Safety Engineers and the regional leader of risk control safety services at Arthur J. Gallagher & Co. in Boca Raton, Florida. The well-publicized report released by Quest on May 8 shows the highest positive drug test percentages in 10 years. Overall, the report showed positive urine drug testing among the combined U.S. workforce in 2016 was 4.2% — an increase over the 2014 rate of 4%. Positive tests for marijuana use continued to climb in both the federally mandated, safety-sensitive and general U.S. workforces, according to the study. In saliva testing, marijuana positivity increased nearly 75%, to 8.9% of the general U.S. workforce in 2016 from 5.1% in 2013. Marijuana positivity also increased in both urine testing — 2.5% in 2016 vs. 2.4% in 2015 — and hair testing —7.3% in 2016 vs. 7% in 2015 — in the same population. While some drug screens can gauge for levels of intoxication — indicating whether a worker is intoxicated at the time of being in the workplace or at the time of an accident — marijuana can only test for presence in the body, Mr. Sample said, adding that the science to gauge marijuana intoxication is “a very long way off.” “Trying to develop a recognized national standard for impairment for alcohol took some time,” he said. “In terms of marijuana, there is no data that would help guide or adequately say what impairment is.” Testing for marijuana, unlike that for alcohol, is a predicament for employers because there is no way to scientifically tell whether a person ingested the drug that same day, over the weekend or over the past month, experts have noted. Companies — except, for example, those in the transportation industry required to test for drugs by federal regulations — are stepping away from drug screens as a way to avoid issues filling positions, especially in states with approved recreational and medical marijuana. Another issue is that some states prohibit employers from firing or not hiring an employee with a medical marijuana card, said Adam Kemper, Fort Lauderdale, Florida-based senior counsel with Greenspoon Marder L.L.P. The issue could put the employer in violation of the federal Americans with Disabilities Act, he said, adding that the issue has employers perplexed. “I think a lot of employers are stepping away from (workplace drug) testing because they don’t want to get into knowing whether their employees are using and then considering whether or not they have to take action, or whether taking action would be an ADA violation,” he said. “If the employee is performing, maybe the employer doesn’t want to intrude on the employee’s life. That’s the reality a lot of times. You have employers looking at performance (on the job) only.” Dr. Todd Simo, Charlotte, North Carolina-based chief medical officer for the drug screening firm HireRight L.L.C., isn’t convinced employers will pull back from testing for drugs — even with what he called slight dips. “Companies spend three times on medical care costs for workers on illicit drugs,” Dr. Simo said, noting other benefits for companies who opt to drug-test their workers such as improving productivity or decreasing absenteeism. The dip in testing for marijuana, which Mr. Smith of ASSE called “alarming,” could also be the result of the U.S. Occupational Safety and Health Administration’s electronic record-keeping regulation, which discourages employers from conducting drug testing post-injury. “I don’t think drug testing is going away,” he said. “I know some people have stopped doing it as a result of OSHA,” which is making “the assumption that people will not report (injury) claims because of drug testing.” In 2017, ASSE recommended that OSHA rescind the electronic recordkeeping rule, which requires certain employers to annually electronically submit injury and illness data that they are already required to record on their on-site OSHA Injury and Illness forms. Employers have objected to the rule’s limitations on incident-based employer safety incentive programs and/or routine mandatory post-accident drug testing programs. They were also troubled by the anti-retaliation provisions in the rule, which established a new, citation-based pathway for employee complaints. The rule “created a lot of confusion for employers,” Mr. Smith said. Author: Louise Esola When it comes to managing risk in the workplace, knowledge is power. The Liberty Mutual Workplace Safety Index helps employers, risk managers, and safety practitioners make workplaces safer by identifying critical risk areas so that businesses can better allocate safety resources. Developed annually, the index ranks the top 10 causes of serious, nonfatal workplace injuries by their direct costs to U.S. businesses. According to the 2018 Liberty Mutual Workplace Safety Index, serious nonfatal workplace injuries amounted to nearly $60 Billion dollars a week spent by businesses on these injuries. Overexertion involving outside sources ranks first among the leading causes of disabling injuries. This event category includes injuries related to lifting, pushing, pulling, holding, carrying, or throwing objects. Overexertion costs businesses $13.67 billion in direct costs and accounts for 23.4 percent of the overall national burden. Falls on same level ranks second with direct costs of $11.23 billion and accounts for 19.2 percent of the total injury burden. Falls to a lower level ranks third at $5.85 Billion and 9.1 Percent. Other exertions or bodily reactions ranks fifth at $4.19 Billion and 7.2 percent of the total injury burden. These top 5 injury causes account for 68.9 percent of the total cost burden.

While businesses have traditionally subcontracted certain tasks to independent contractors, the on-demand or “gig” economy has seen this practice skyrocket with the business models used by Uber, Lyft, GrubHub, TaskRabbit and many other tech companies. To a limited extent, nonprofits also depend on independent contractors to perform functions where regular staff do not have the expertise, or for temporary or limited projects. There is little risk when subcontracting is done through a business, such as hiring a temporary worker through a staffing agency where the worker is the employee of that agency. But when a nonprofit is hiring an individual worker to perform tasks that falls within the scope of the nonprofit’s mission, the classification of independent contractor just became much more risky due to the recent California Supreme Court decision in Dynamex Operations West, Inc. v. Superior Court of Los Angeles.

In its lengthy decision, the Supreme Court analyzed the basic public policy objective of the California Wage Orders, which were adopted to establish minimum wage, overtime, and meal and rest breaks for non-exempt employees. The court noted that these laws ensure responsible employers are not hurt by competitors realizing the potentially substantial economic benefits of substandard employment practices (such as non-compliance with minimum wage, overtime, meal and rest breaks, insurance benefits, etc.), that could result in a “race to the bottom.” After analyzing the definition of “employee” under the Wage Orders, as well as the existing multi-pronged independent contractor test and legal tests used by other jurisdictions, the Court determined that a simplified “ABC” test should be used to evaluate whether a worker is classified as an independent contractor for purposes of California Wage Orders. So how does this simplified test work? The ABC test presumptively considers all workers to be employees, and permits workers to be classified as independent contractors ONLY IF the hiring business demonstrates that the worker in question satisfies all three of the following conditions:

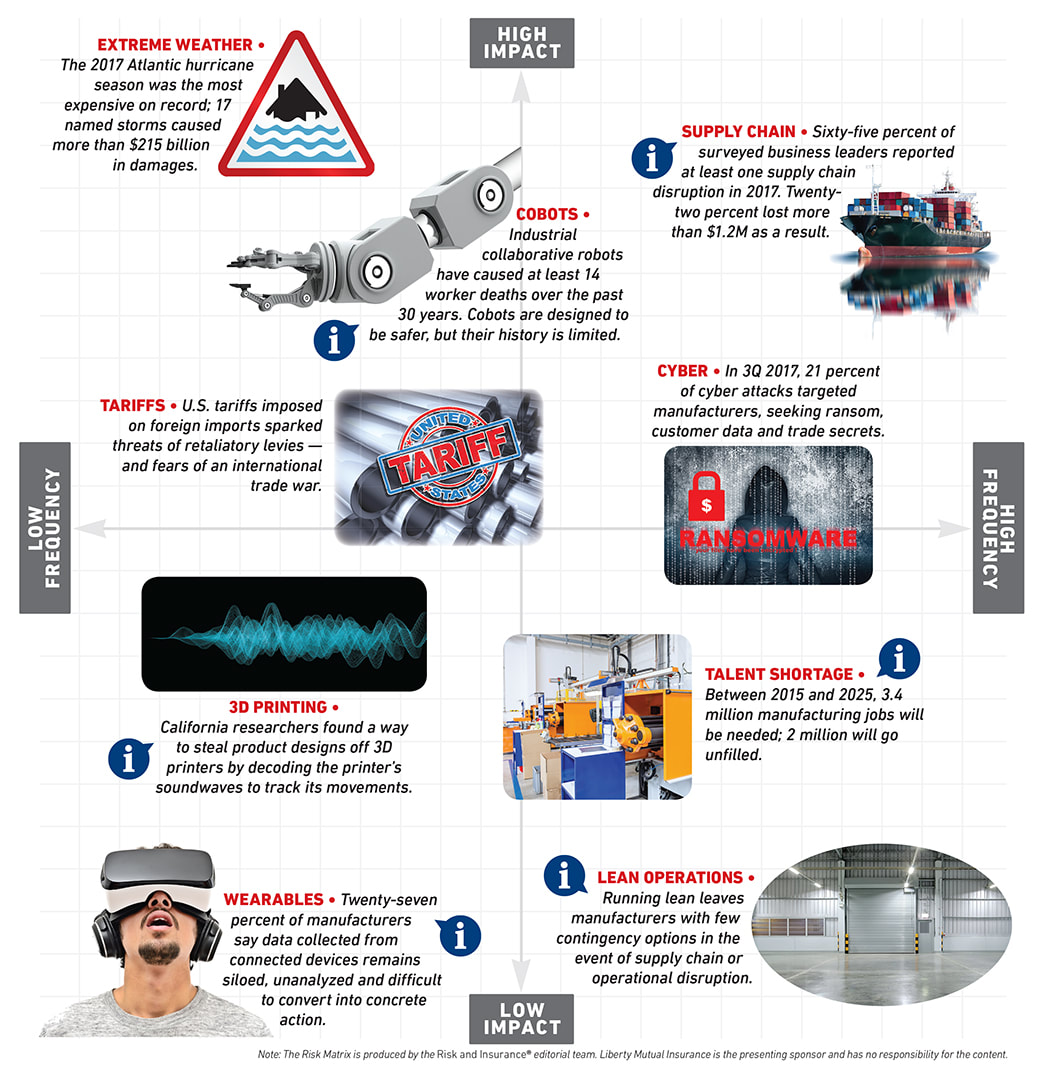

The most difficult prongs of the test to meet for most workers will be prongs B and C, so nonprofits analyzing worker classification should likely start with their mission statement and purpose. If an employee is working to further that mission, then under condition B, that worker is likely an employee and no further analysis is necessary. Going on to condition C, by way of example, while a plumber or an IT technician are not likely to fall within the mission of a social services nonprofit, whether they are in an independently established trade, occupation or business will need further examination. A licensed plumber in a separate business clearly is, but an IT technician may or may not be. Condition A, who directs and controls the worker in the performance of their work, will always require a case-by-case evaluation. Finally, remember that this Supreme Court case involved the definition of “employee” for purposes of the California Wage Orders. Different employment laws have different definitions of “employee,” so it is possible that a worker may properly be classified as an employee with reference to one law but not another. Nevertheless, once a worker is classified as an employee for Wage Order purposes, they likely should be similarly classified for all other compliance purposes. Nonprofits that have workers classified as independent contractors now or over the past three years (the applicable statute of limitations on wage claims) should re-evaluate that classification under this narrowed definition to assess whether there is potential liability for wages or penalties for the work performed. Ellen Aldridge Nonprofits Insurance Alliance Group Cobots, tariffs and extreme weather are just a few examples. See our map of the top current exposures plotted by frequency and impact.

Lloyd’s of London has directed its underwriters to terminate any insurance programs they have with the National Rifle Association (NRA) and to not enter into any new ones. “The Lloyd’s Corporation has given very careful consideration as to whether syndicates at Lloyd’s should continue to insure programmes offered, marketed, endorsed or otherwise made available through the National Rifle Association of America,” Lloyd’s said in a statement.

Noting that NRA programs are now subject to an inquiry by the New York Department of Financial Services (NYDFS), the statement said the Lloyd’s Corp. has decided to end its association with any NRA business. It gave no indication of how much or what business Lloyd’s may have with the NRA. The New York inquiry into NRA’s insurance, in particular its Carry Guard personal liability insurance program for members, has thus far resulted in fines for broker Lockton ($7 million) and insurer Chubb and its excess and surplus lines subsidiary, Illinois Union ($1.3 million). These two firms that administered and underwrote the Carry Guard program also signed agreements in which they acknowledged that the policies they offered violated state law and agreed to stop participating in membership programs with the NRA. According to New York officials, Carry Guard is not the only NRA insurance program under scrutiny. From approximately January 2000 through March 2018, Lockton and the NRA offered at least 11 additional insurance programs through Lloyd’s to new and existing NRA members in New York and elsewhere. Among the NRA programs from Lloyd’s now available on the NRA website are ArmsCare and Firearms insurance protecting firearms from theft or damage in excess of a homeowners’s policy; firearms’ instructor liability insurance; retired or off-duty law enforcement officer liability insurance and gun collectors’ insurance. Prior to the New York probe and fines being announced, both Chubb and Lockton had indicated they were pulling out of the NRA insurance programs. In so doing, they joined MetLife (which had offered NRA members discounts on home, car, boat and motorcycle insurance), United Airlines and other companies in canceling their business ties with the gun owners’ organization. The Carry Guard program provides NRA members with personal liability insurance protection in the event they are charged with a crime after defending themselves with a firearm. The program also includes a safety training component and a free one-year NRA membership. The insurance promises to mitigate the financial and legal consequences that might arise from armed encounters, even if the member did everything right. DFS said the Carry Guard program “improperly provided” coverage in any criminal proceeding against the policyholder including coverage for bail money, premiums on bonds, attorney consultation fee and retainer expenses, expenses incurred for the investigation or defense of criminal charges, and costs taxed against the insured or the insured’s resident family member in a criminal proceeding arising out of a shooting. New York DFS officials determined that some of the Carry Guard coverages themselves and limits are not permissible under the state’s law. The NRA is also suing Lockton Cos., alleging the insurance broker breached its contract with the firearms lobbying group. The NRA suit, filed in the Eastern District of Virginia, alleges the New York investigation was “orchestrated” by the gun control organization Everytown for Gun Safety. This is not the first time Lloyd’s has pulled away from a controversial market. Insurance Journal reported in June, 2015 that Lloyd’s had stopped insuring marijuana industry firms of any kind due to conflicts between federal and state laws over their legality. The company said then it had considered various requests with respect to insuring marijuana or marijuana related businesses, either medicinal or recreational in the United States, and determined that it no longer would do so until the drug is formally recognized by the U.S. government as legal. - Andrew G. Simpson Drug use by the American workforce remains at its highest rate in more than a decade, driven by increases in cocaine, methamphetamine and marijuana. However, prescription opiate positivity rates have declined.

On April 30, 2018, the U.S. Court of Appeals for the Ninth Circuit rejected the Hemp Industry Association’s challenge to a 2016 Drug Enforcement Administration (DEA) rule that, among other things, classified cannabidiol (CBD) as a Schedule 1 controlled substance (Rule). CBD is non-psychoactive compound that is typically derived from industrial hemp, which is a variety of the cannabis plant. Industrial hemp has low levels tetrahydrocannabinol (THC) – the psychoactive compound in marijuana – and high levels of CBD. CBD’s sales have skyrocketed because it is seen as a viable treatment for epilepsy, pain, anxiety, and other ailments without the psychoactive effects caused by THC. CBD has also become more accessible due to an amendment to the 2014 Farm Bill that legalized industrial hemp containing less than 0.3% THC for pilot programs at research institutions in states where industrial hemp has been made legal.

Although hemp is not psychoactive, the DEA Rule did not differentiate between hemp and marijuana but rather classified all extracts derived from Cannabis plants as Schedule 1 controlled substances, including hemp-derived CBD. Consequently, Hemp Industries Association and other petitioners challenged the DEA Rule, arguing that the DEA overstepped its rulemaking authority by adding CBD to the Controlled Substances Act – an action that requires an act of Congress. They also argued that the 2014 Farm Bill’s hemp provision prevents law enforcement officials, including the DEA, from interfering industrial hemp cultivation that was legalized by the 2014 Farm Bill. The 9th Circuit panel upheld the DEA’s Rule and found that DEA has authority to list CBD as a marijuana extract as defined by the Rule (click here to view the opinion). The court also found that although the 2014 Farm Bill allowed certain parties to grow industrial hemp, the DEA’s Rule does not interfere with those parties’ right to cultivate industrial hemp pursuant to that law. The decision also clarifies that states that permit the sale of CBD are violating federal law because CBD is classified as a Schedule 1 controlled substance, which was previously a legal gray area. While the decision may chill the CBD boom taking place across the country, it may also spur action at the federal level. For instance, the Hemp Farming Act of 2018 introduced by Republican Senator Mitch McConnell (R-KY) earlier this year would remove hemp, and therefore hemp-derived CBD, from the Controlled Substances Act, and would effectively supersede the DEA’s Rule if passed into law. Disclaimer Possessing, using, distributing, and/or selling marijuana or marijuana-based products is illegal under federal law, regardless of any state law that may decriminalize such activity under certain circumstances. Although federal enforcement policy may at times defer to states’ laws and not enforce conflicting federal laws, interested businesses and individuals should be aware that compliance with state law in no way assures compliance with federal law, and there is a risk that conflicting federal laws may be enforced in the future. No legal advice we give is intended to provide any guidance or assistance in violating federal law. This information is intended to inform clients and friends about legal developments, including recent decisions of various courts and administrative bodies. This should not be construed as legal advice or a legal opinion, and readers should not act upon the information contained in this email without seeking the advice of legal counsel. Courtney Krause, Joshua Mandell, and Jonathan Robbins. AUTHOR: Judy Greenwald The U.S. Equal Employment Opportunity Commission has filed suit against supermarket chain Albertsons Inc., charging it violated federal law when it allegedly prohibited Hispanic employees from speaking Spanish around non-Spanish speakers, including when they spoke to Spanish-speaking customers and during breaks.

The EEOC said in a statement Thursday that Albertsons’ San Diego Hispanic employees were subjected to harassment and a hostile work environment through the implementation of the no-Spanish policy, in violation of Title VII of the Civil Rights Act of 1964. “Employers have to be aware of the consequences of certain language policies,†said Anna Park, regional attorney for the EEOC’s Los Angeles District Office, which includes San Diego County in its jurisdiction, in the statement. “Targeting a particular language for censorship is often synonymous with targeting a particular national origin, which is both illegal and highly destructive to workplace morale and productivity.†A spokesman for the Boise, Idaho-based chain could not immediately be reached for comment. California Insurance Commissioner Dave Jones said Tuesday that California Mutual Insurance Co. has become the first insurer in the state approved to provide coverage to property owners who rent out space to cannabis businesses. Lessor’s risk coverage provides liability and property insurance for commercial property owners who lease building space to commercial tenants, said the department in its statement. Specific commercial activities and businesses addressed by this coverage include cannabis labs, product manufacturing, cultivation and dispensary operations.

Steve Miller, president of Hollister, California-based California Mutual, said the coverage being offered is the same as the insurer offers to other types of businesses. “Prior to this, we probably would have gotten off the risk if the tenancy was related to the cannabis industry. Now, with the permits and policies in place, we feel more comfortable with it,” he said. The insurer has not written any of this coverage so far, he said. Mr. Miller stressed the policy will provide coverage just for the landlord, not for the cannabis business itself. Mr. Jones has been continuing to urge insurers to cover the state’s cannabis industry amid reports that President Donald Trump’s administration will not crack down on states allowing the use of marijuana. Judy Greenwald |

Contact Us

(858) 569-8100 Archives

September 2018

Categories

All

|

- Home

-

Insurance

-

Business Insurance

>

- Auto Service & Repair Businesses

- Contractor's Insurance

- General Liability

- Excess Liability / Umbrella

- Commercial Auto

- Commercial Property

- Business Owners Package (BOP) Insurance

- Business Package Policy

- Workers Compensation

- Employment Practices Liability

- Professional Liability

- Cyber Liability

- Insurance Bonds

- Directors and Officers Liability

- Personal Insurance >

- Special Lines >

-

Business Insurance

>

- Service

- About

- Contact

- Podcast

Agency Licenses

Network One Insurance - CA. Lic. # 0b17024

Bill Corley Insurance Agency - CA. Lic. # 0547239

Navigation |

Follow UsShare This Page |

Contact Us

Bill Corley Insurance/Network One Insurance

170 Eucalyptus Avenue Ste 130 Vista, CA 92084 Phone 1: (858) 569-8100 Phone 2: (408) 224-4650 Fax: (408) 604-0935 Click here to Email Us |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed