|

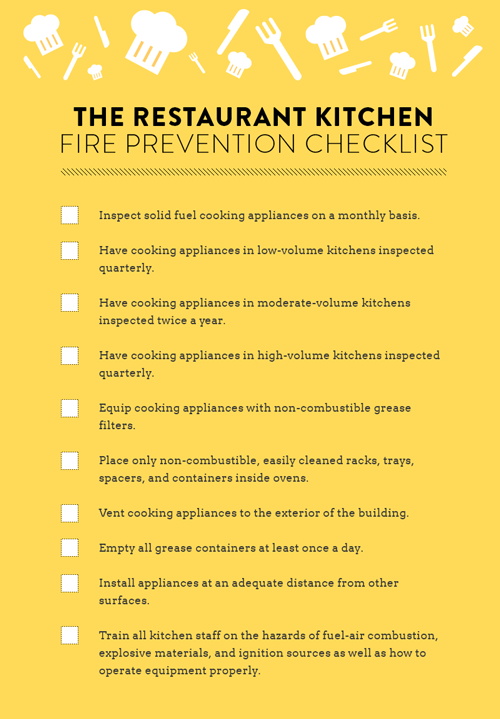

Keeping your kitchen safe from fires requires regular maintenance, inspection, and cleaning of kitchen appliances and surfaces. We have developed a helpful restaurant kitchen fire prevention checklist to help you reduce the risk of fire and be prepared in case one does occur.  Restaurant Kitchen Fire Prevention Here is our guide for the perfect restaurant kitchen fire prevention checklist. Inspect solid fuel cooking appliances on a monthly basis.

Cooking with solid fuel like wood and charcoal can significantly increase the risk of a kitchen fire because of the thick, flammable residue (creosote) these fuels deposit in the exhaust system. A monthly inspection and regular cleaning ensures the thick smoke and grease from wood or charcoal cooking does not build up to dangerous levels. Have cooking appliances in low-volume kitchens inspected quarterly. Low-volume kitchens are typically found in places like churches and community centers where cooking takes place occasionally. These facilities still require an annual inspection to ensure all appliances pose no risk for electrical or grease fires. Have cooking appliances in moderate-volume kitchens inspected twice a year. Moderate-volume kitchens, such as those found in many sit-down restaurants, should have appliances inspected twice a year. The inspection agency will likely recommend strategies for keeping your kitchen clean and safe in the time between checks based on what they see. Have cooking appliances in high-volume kitchens inspected quarterly. High-volume and 24-hour kitchens require quarterly inspections. Kitchens operating at a high volume should be especially careful about keeping all surfaces clear of flammable grease. Equip cooking appliances with non-combustible grease filters. The grease filters on all exhaust hoods should be non-combustible and easy to remove for cleaning. Since grease can easily catch fire, regularly cleaning greasy surfaces goes hand in hand with routine inspections. Equipment that can be easily taken apart and put back together for maintenance purposes can improve your fire safety routine. Place only non-combustible, easily cleaned racks, trays, spacers, and containers inside ovens. Like grease filters, all cooking equipment used inside an oven should be non-combustible and easy to clean. Keeping oven surfaces and equipment clean reduces the amount of flammable grease exposed to the oven’s heat source. In most cases, hot water and soap are sufficient for cleaning these surfaces and chemical degreasing agents are available for more difficult grease deposits. Vent cooking appliances to the exterior of the building. All exhaust should vent to the exterior of your building. An inefficient ventilation system keeps greasy exhaust, which can accumulate and raise the risk of fire inside the building. Check with your local inspection requirements to see if your ventilation systems are in compliance with your area’s kitchen codes. Empty all grease containers at least once a day. Even in a moderate-volume kitchen, grease can accumulate quickly. Deep fryer oil should be changed at least once a day for fire safety purposes. Grease pans for stoves and other appliances should also be cleaned daily. Grease traps beneath sinks are an exception– they typically require monthly maintenance and may be emptied by a professional when due for a cleaning. Install appliances at an adequate distance from other surfaces. Kitchen appliances operated too closely to adjacent surfaces are at risk for overheating and causing a fire. Check your local kitchen inspection requirements for a better understanding of how far each kind of appliance should sit from walls, cabinets, and other appliances. You can also see if walls neighboring appliances like ovens and fryers need to be treated with specific fire-proofing materials. Train all kitchen staff on the hazards of fuel-air combustion, explosive materials, and ignition sources as well as how to operate equipment properly. All staff who comes in contact with or operates kitchen equipment should be trained to use each appliance properly. In addition to knowing the fire safety details of each appliance, staff should be taught about common fire risks, how regular cleaning and maintenance decreases these risks, and what to do in the event of a kitchen fire. With regular maintenance, inspection, and cleaning, you can greatly reduce the risk of fire in your kitchen. As always, be sure to adhere to your local fire safety standards and follow this checklist to keep your kitchen safe. If you follow this restaurant kitchen fire prevention checklist, you will definitely reduce your chances for a fire and be prepared if a fire does occur.

0 Comments

On average, more than 100,000 wildfires light up the landscape each year in the western portion of the United States. It’s not uncommon for fire to burn through more than two million acres across states like California, Texas, New Mexico, Colorado, and throughout the West and Southwest.

Fire and Life Safety Educators are invited to speak at a variety of venues. Careful planning can make the difference between an excellent visit and a mediocre one. While some folks are intimidated by longer sessions, it is the shorter ones that can be the most difficult. 10-minute mini-lesson plansThe 10-Minute mini-lesson is a helpful strategy life safety educators can implement in a variety of settings. Worship services, gatherings at the local senior center, or service club meetings may all be potential opportunities to deliver short fire safety presentations with specific audiences. audiences.

A 30-minute lesson provides the instructor an opportunity to address information related to fire safety as well as a chance to help participants develop health-enhancing attitudes around the topic. Additional time could also be used to help participants practice new skills. An increase in time does not mean you need to increase the amount of content you are covering. Remember, sometimes depth wins over breadth. 60-minute lesson plan60 minutes is a nice chunk of time to provide an effective fire safety lesson. An hour allows the instructor to cover content with depth as well as provide an opportunity for participants to explore helpful attitudes and practice related skills. Remember to engage learners in a different ways keep their attention for the entire lesson. NEW! Early adolescent lesson plans (Ages 10-14)

Members of the work group include:

Kitchen Fire Prevention A Hazard in the Home Half of house fires begin in the kitchen, and kitchen fires are the leading cause of house-fire injuries and many deaths. Most kitchen fires are due to human error. Preventing kitchen fires and injuries takes one part common sense and a few parts preparation. Take stock of your: Kitchen's layout, equipment, and cleanliness. Cooking habits. Ability to put out a small fire safely. Knowledge of burn-injury prevention.

Clean and Safe A clean kitchen is a safer kitchen. Wipe up spills as they happen. Clean crumbs and grease buildup from cooking appliances regularly. Clean the exhaust hood and duct over the stove on a regular basis. Grease can catch fire easily, and grease fires can be difficult to put out. Keep messes under control to avoid these risks altogether. First Aid for Burns Act fast to limit the severity of burns. Run cool water over a minor burn for 10 to 15 minutes to limit its seriousness. Never use grease or butter on a burn. If burned skin is blistered, see a doctor. For blackened skin, shallow breathing, or unconsciousness, call the fire department or ambulance service. Recipe for Safety Careless cooking starts more residential fires than any other cause. Cooking accidents also hurt people – more are injured in the kitchen than from any other fire-related cause. Brush up on kitchen safety and cook smart. The Kitchen: Get It Together Organize and decorate the kitchen for looks and safety. Everyday objects may end up causing destructive blazes. Do not store anything flammable on the stove. Curtains, potholders, dishtowels, and decorative items need to be at least 3 feet from the stove. Get an ABC fire extinguisher for the kitchen and learn how to use it. Keep the extinguisher in easy reach near the kitchen's exit – not in a cabinet. Make sure the control knobs on the stove, oven, and other hot appliances are easy to read. You should be able to tell from across the room whether a heat-producing appliance is on or off. Check toasters, coffeemakers, and electric skillets for overheating and wear. Signs of possible damage are cracks, melting, or discoloration of cords or plastic surfaces. Do not overload electrical outlets. It can cause overheating. This is especially true with heatproducing appliances like toasters or coffeepots. Safe Steps It is easy to develop bad cooking habits. Don't get burned. Never leave food cooking unattended. Cook with the lowest effective temperature. Do not store cooking fat on the stovetop. A burner could be turned on, accidentally starting a grease fire. Plug in appliances only when they are in use. Keep metal out of the microwave - even a twist-tie or a bit of aluminum foil can cause "arcing," which can lead to fire. Wear close-fitting clothing when you cook. Avoid loose sleeves, ties, or ruffles. Keep pot handles turned toward the back of the stove. An adult may brush against the handle, or a child may pull the pot off of the stove and be burned. Supervise young children in the kitchen. Do not touch or try to move a flaming pot. You may spread the fire and/or burn yourself. Slowly remove lids from containers that have been in the microwave oven. The steam that builds up inside containers can cause serious scalds. Putting Out the Flames Never try to put out a fire yourself unless: You have called the fire department. You know what is burning. You have the necessary supplies (pan lid or correct fire extinguisher). The fire is small and not spreading. Everyone else has left the area. You have a clear path to the exit. Never use water, baking soda, or flour on a grease fire. Instead, carefully slide a lid over the pan from the side, and turn off the stove. Keep the lid over the fire until flames are out. Smother a fire in a conventional oven or microwave oven by keeping the door closed. Unplug or turn off the unit. Have the microwave serviced before using it again. If paper, cloth, or food (other than grease) is burning, it may be safe to use an A or ABC fire extinguisher, if you know how. A fire extinguisher labeled C, BC, or ABC can be used on an electrical fire. If the fire does not go out right away, exit. If you haven't done so already, call the fire department, using a neighbor's phone. People who text while driving are six times more likely to be involved in a car crash while those who talk on a mobile device while driving increase their crash risk more than two times. Yet many drivers are still willing to take the risk, as “fear of missing out” and separation anxiety keep them from abiding by the law, according to a new study. States have adopted laws that require drivers to use hands-free devices. However, many drivers simply don’t perceive texting and driving to be dangerous in certain driving scenarios.

The study found that females are more likely than males to engage in mobile phone use while driving. Also, more experienced drivers are less likely to engage in distracted driving. Results show that as the number of years with license increase, the probability of participating in distracted driving decreases, and drivers who are more disinhibited are more likely to drive distracted. Females are more likely than males to engage in mobile phone use while driving.The study appears in Risk Analysis: An International Journal, which is published by the Society for Risk Analysis. In the study, “Should I text or call here? A situation-based analysis of drivers’ perceived likelihood of engaging in mobile phone multitasking,” researchers uncovered four profiles of drivers with strong intentions of engaging in distracted driving: drivers who are female, drivers who are frequent users of phones for texting/calling, drivers with negative attitudes towards safety, and drivers who are highly disinhibited. Drivers were much more likely to talk on their phones while driving than they were to use their phones to text. This is expected since the visual demands of texting compete directly with those of driving, whereas talking on the phone is mostly auditory, according to the researchers. In the U.S., mobile phone usage has been a factor in one quarter of all car collisions. However, actual crash risks vary based on the type of task being performed and the extent of its cognitive and physical demands on the driver. Talking on a mobile device increases crash risk by 2.2 times whereas texting increases risk by 6.1 times. Observational studies have found that as many as 18 percent of drivers in high-income countries, and up to 31 percent in low- and middle-income countries, use their mobile devices while on the road, contributing to significantly reduced road safety. Despite laws prohibiting such behavior, mobile phone use while driving is expected to increase. The researchers found that drivers engage in self-regulation when deciding whether to use their phones while driving, as they try to cope with environmental factors while maintaining a high level of performance. For example, many drivers make use of stops to initiate using their mobile device, and many are able to restrain themselves to using phones only while stopped at intersections with signals. Other researchers have also noted that drivers usually restrict engagement in heavy traffic or along curved sections of both urban and rural roads. “Drivers are not good at identifying where it is safe to use their phone. It is safer for drivers to just pull over in an appropriate place to use their phone quickly and then resume their journey,” stated one of the authors, Oscar Oviedo-Trespalacios. Sixty-eight percent of participants reported needing a lot of convincing to believe in the dangers of texting and driving. The researchers found these people include those who who believe the effects on the driver are minor. However, the study found that demanding traffic conditions and the presence of law enforcement were effective in reducing the likelihood of distracted driving. The authors say that these results support high-visibility police enforcement programs as a means to combat distracted driving. In the study, 447 drivers in South East Queensland, Australia, answered questions about perceived crash risk, perceived driving comfort, perceived driving difficulty, perceived driving ability, perceived likelihood of engaging in a voice call and perceived likelihood of engaging in texting. The research team included Oscar Oviedo-Trespalacios, Md. Mazharul Haque and Mark King from Australia Queensland University of Technology, and Simon Washington from the University of Queensland. The authors say the results from this study may contribute to more targeted distracted driving campaigns by highlighting opportunities for interventions. These campaigns should target safety attitudes to more effectively curb drivers’ motivations for engaging with their phones while driving. They say this study also confirmed the need to profile and target high-risk groups, particularly novice drivers and those who are overly attached to their phones, to develop messaging that considers their particular motivating factors. The Society for Risk Analysis FPI Management, a property company in California, wants to hire dozens of people. Factories from New Hampshire to Michigan need workers. Hotels in Las Vegas are desperate to fill jobs.

As a small business owner, you have a lot on your plate. From accounting, to marketing and sales, to product development and inventory — the to-do list can seem never ending. That’s why it’s no surprise that details like liability insurance can so easily slip through the cracks, leaving your business financially vulnerable. Unfortunately, nearly anyone your business interacts with can make claims against you. And without the right insurance protection, these claims could cripple your operation.

What General Liability Insurance Covers General liability (GL) coverage can be part of a standalone policy or can be part of a business owner’s policy (BOP). This coverage safeguards your business’ finances and reputation in the event a customer or third party takes legal action against you or your employees. The following are types of claims covered by a GL policy:

What General Liability Insurance Doesn’t Cover GL coverage does have limits — both in dollar amounts and types of situations covered. This depends on a number of factors, including your specific industry and your business’s exposure to visitors and clients. However, there are a few limits that apply to businesses across the board. GL does not cover the following types of damages:

To learn more about how Liberty Mutual can protect the investment you’ve made in your business, visit our general liability page or connect with an independent insurance agent today. California Insurance Commissioner Dave Jones has approved the first Cannabis Business Owners Policy in the State of California. The American Association of Insurance Services designed the new CannaBOP program for cannabis dispensaries, storage facilities, processors, manufacturers, distributors, and other cannabis-related businesses operating in the state. “Cannabis businesses need insurance coverage to help them recover when something goes wrong just as any other legalized business does,” Jones said in a statement. “This first-of-its-kind Cannabis Business Owners Policy or CannaBOP program will make it easier for more insurers to enter the market and fill coverage gaps for cannabis businesses. I encourage insurers to take advantage of this new standardized CannaBOP program to file more cannabis insurance products with the department to meet the needs of this emerging market.” AAIS developed a California-specific business owners policy (BOP) program for the cannabis industry, complete with forms, rules and rating information. The CannaBOP program provides a package policy containing both property and liability coverage for qualifying California cannabis dispensaries, storage facilities, distributors, processors, manufacturers, and other businesses participating in or supporting the California cannabis industry.

Commissioner Jones launched an initiative last year to encourage commercial insurance companies to write insurance to fill coverage gaps for the cannabis industry. The first filing and approval of commercial insurance for the cannabis industry from an admitted carrier was announced in November of last year, the first surety bond program for the industry was announced in February and the first coverage for commercial landlords for the industry and a product liability and product recall program for the industry were announced last month. There are also roughly 20 surplus lines writers offering cannabis insurance. The California Senate has approved legislation that seeks to clarify homeowners’ insurance coverage following deadly mudslides near Santa Barbara. Insurance policies generally cover damage caused by fires but not by mudslides. That creates confusion in cases like the mudslides in Montecito, which were triggered by a wildfire. In such cases where multiple factors combine to cause damage, courts have ruled that insurers must pay if the policy covers the “efficient proximate cause,” the most important cause, of the damage.

Most insurers have agreed to cover damage in Montecito, but Sen. Hannah Beth Jackson thinks enshrining the existing legal doctrine in law would help future mudslide victims avoid prolonged fights with insurers. “It is important that the insurance industry know very clearly, without equivocation, their responsibility to their policyholders that they must cover these costs,” said Jackson, a Democrat from Santa Barbara. Insurers oppose the bill. Their lobbyists say it goes further than the existing legal interpretation and might force them to cover losses they wouldn’t otherwise have to cover. That could require them to raise their rates or decline to offer coverage in some areas, they say. “When you put something in statute, any interpretation of the courts, they’re going to presume that there’s a change in law,” said Armand Feliciano, vice president of government relations for the Property Casualty Insurers Association of America. “Otherwise why would the Legislature do it? Now you’ll have other lawsuits that probably didn’t need to happen.” The measure specifically says it’s not intended to change existing law, but Feliciano said there could still be legal disputes over the meaning. SB917 was approved in a 25-11 vote and goes next to the Assembly. More than $421 million in insurance claims have been filed for residential and commercial losses related to the mudslides, Insurance Commissioner Dave Jones said last month. Recently burned by California’s largest recorded wildfire, the hillsides of Montecito northwest of Los Angeles could not absorb the rainstorm with an epic downpour of nearly an inch (2.5 centimeters) in 15 minutes early on Jan. 9. Twenty-one people were killed and two remain missing. By Jonathan J. Cooper |

Contact Us

(858) 569-8100 Archives

September 2018

Categories

All

|

- Home

-

Insurance

-

Business Insurance

>

- Auto Service & Repair Businesses

- Contractor's Insurance

- General Liability

- Excess Liability / Umbrella

- Commercial Auto

- Commercial Property

- Business Owners Package (BOP) Insurance

- Business Package Policy

- Workers Compensation

- Employment Practices Liability

- Professional Liability

- Cyber Liability

- Insurance Bonds

- Directors and Officers Liability

- Personal Insurance >

- Special Lines >

-

Business Insurance

>

- Service

- About

- Contact

- Podcast

Agency Licenses

Network One Insurance - CA. Lic. # 0b17024

Bill Corley Insurance Agency - CA. Lic. # 0547239

Navigation |

Follow UsShare This Page |

Contact Us

Bill Corley Insurance/Network One Insurance

170 Eucalyptus Avenue Ste 130 Vista, CA 92084 Phone 1: (858) 569-8100 Phone 2: (408) 224-4650 Fax: (408) 604-0935 Click here to Email Us |

Location |

Website by InsuranceSplash

RSS Feed

RSS Feed